Good morning, and welcome to March (already!)

We are pleased to provide an update from Insight Investments (attached) as well as some of our own comments.

Back in 1980, famed Producer Martin Scorsese teamed up with Robert DeNiro, Joe Pesci and some other all-stars for the movie “Raging Bull”, which went on to score DeNiro a Best Actor Oscar for his portrayal of former middleweight champion, Jake LaMotta. LaMotta was nicknamed ‘the Raging Bull’ for his brawling, bullying and stalking style (most of us have seen this in more recent times from “Iron” Mike Tyson). An investment ‘bull market’ was derived from another of the animal’s characteristics. Bulls thrust their horns up in attack, symbolising the upwards movement in share prices.

By contrast, ‘bear markets’ and their falling share prices are named after the downward swiping of a bear’s paws used to defeat its prey. 2024 has mostly continued the raging bull market that started in October last year, particularly for Big 7 in the USA being Apple, Google, Microsoft, Amazon, Meta Platforms, Tesla and Nvidia. The US sharemarket has surged over 30% from its October lows and has pierced through the 39,000 barrier as it made its way to a new all-time high. In fact, it has risen 17 of the last 19 weeks – a hot streak only last achieved way back in 1972 (what a great year that was…. 😉)

But despite this bullish rampage, there is one part of the market that has missed the party and is still being swiped by the bear: the smaller company sector. While that creates challenges in the short term, the good news is that, for patient investors, it is throwing up the most attractive valuations seen in decades and has created fantastic long-term opportunities.

We will continue to support the smaller company sector via the allocations in your portfolios to take advantage of what we see is a rare opportunity. We will also continue to rely on the specialist investment managers within your portfolios to continue to provide downside protection for when we experience the next correction/fall in markets, which as we know is inevitable. The nature of markets for the past 100 years has been 2-3 steps forward and 1 step back and we do not see this changing.

U.S. exceptionalism continues in 2024

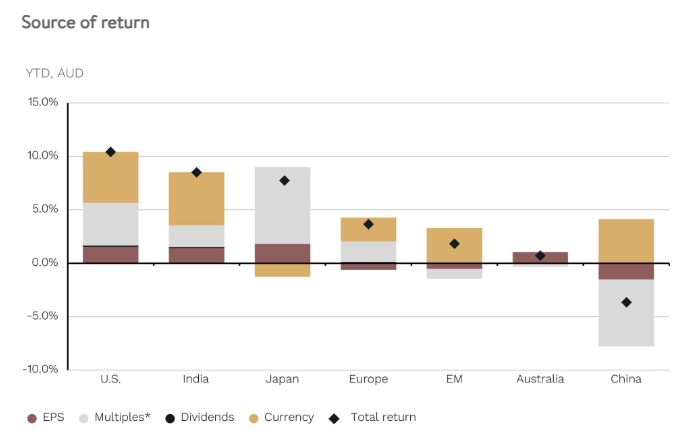

Below, we can see the total returns (represented by diamonds) of the major global share markets, including Australia so far in 2024, in Australia dollar terms.

Source: JP Morgan Guide to Markets.

The USA leads the way, with earnings per share (EPS), valuation multiples and currency (a falling AUD versus USD) all contributing to a total return over 10%. Returns from the Australian share market this year have not been at the same level, with no benefit from currency. Interestingly the Chinese market has been an outlier, falling over 7% (before a currency benefit). Valuation multiples have declined, with a collapsing property market, slowing growth and deflation all sapping investor confidence. But, as mentioned, the smaller company sector also have been a laggard, with U.S. small caps (Russell 2000) down -0.8% in US dollar terms (but a better 4.1% in AUD terms), while Australian small caps are up just 1.1% (all to 9th February).

Why earnings matter most long term

New investors might look at the chart above and worry that there are so many components to manage in generating total investment returns:

• Earnings per share (EPS) growth;

• Expansion or contraction in valuation multiples, such as price-to-earnings ratios;

• Dividend growth; and

• Currency movements.

• The reality, however, is that only one really matters in the long term: EPS growth.

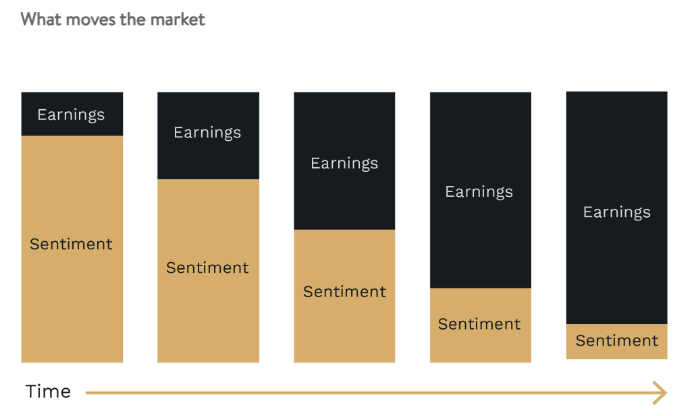

Why? Valuation multiples and currency movements, particularly if investors don’t buy when they are at extremes, tend to ‘wash out’ in the long term. And dividend growth is highly dependent on earnings because dividends cannot grow long term if earnings are not growing. One simple but excellent way of picturing the impact of earnings on both the value of individual company share prices and the price of the share market as a whole, over time, is the chart below.

Over short periods, like a day or a few months, earnings do not move total returns much. You can see this in the red (EPS) bars in the top chart above. The red bars clearly had a smaller impact on total returns over the 5-6 week period covered in 2024. What dominates the movement in share prices and the market in the short term, putting aside any currency movements, is investor sentiment, which is responsible for increasing or decreasing valuation multiples.

A cheery market typically sees multiples increase; a dour market sees multiples fall. Unless you are possessed with an other-worldly ability to predict the future sentiment of the masses, the sentiment prediction game is a tough one to win and is more akin to gambling at the casino. For the long-term investor, though, sentiment matters little. Earnings win the day, long term. As famed investor Peter Lynch, who ran the successful Magellan Fund at Fidelity back in the 1970s and 80s once said:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies.”

We trust this is informative, however please do not hesitate to contact us should you have any queries or questions.