We trust you are keeping well and we hope all our farming clients are enjoying an incident-free harvest and gaining outstanding results thus far.

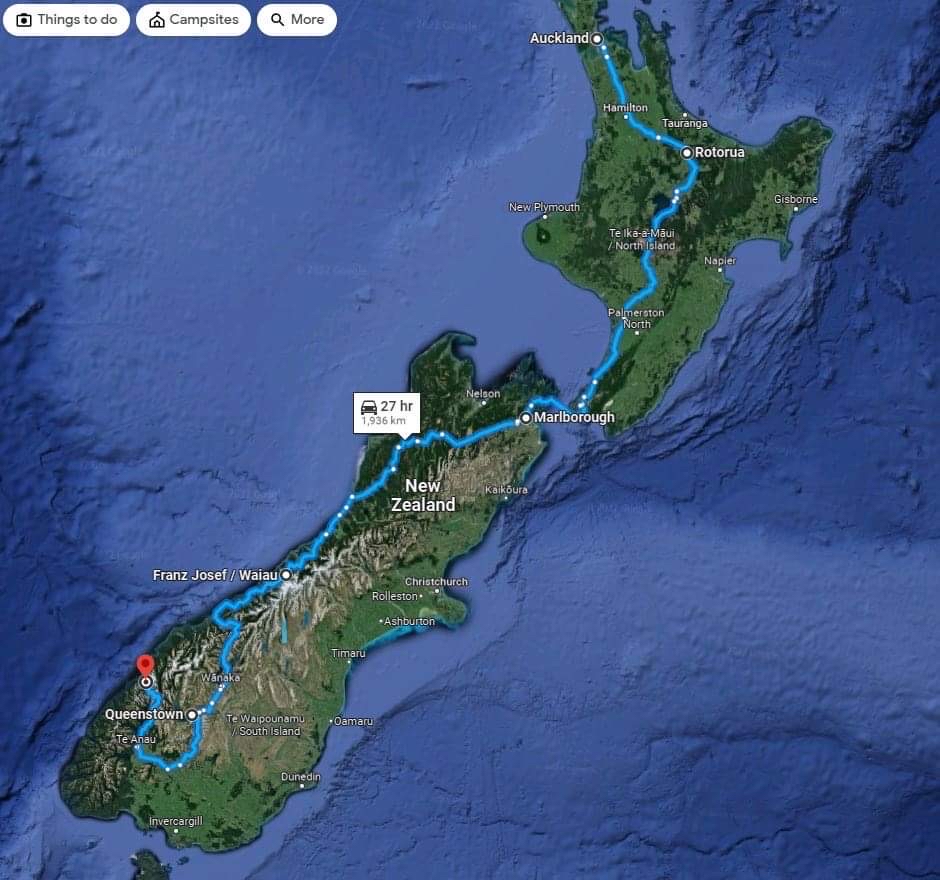

As some would know, my family and I were very fortunate to take a break recently and had the privilege of touring New Zealand and all it has to offer. We had high expectations of this amazing land, and to say that those expectations were exceeded is a gross understatement. If you haven’t already done so, we would recommend you put a holiday to NZ on the bucket list as it is an absolutely stunning country, the people are very friendly (even to Australians!) and the experiences were incredible. I have attached a photo of my first experience in snow – good things come to those who wait as I am now 50 and it was my first time sinking my feet into fluffy, white snow. It was amazing, however I almost dislocated a shoulder trying to win the snowball fight. Unfortunately our eldest son Taylor had to fly home the day before the snow trip due to his work commitments.

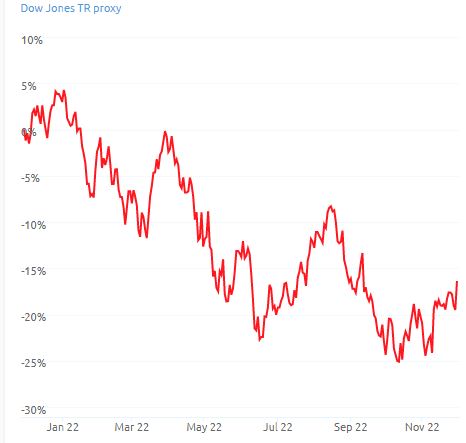

Whilst we were away we were pleased to see the continued recovery of the various investment markets throughout the world. As you may know the September quarter 2022 was a very negative one, however markets have recovered strongly in October and November and subsequently portfolio values are looking more favourable. This is not to say we will not experience further negativity in the short term as recession issues, higher interest rates and inflation continues to present significant challenges to world economies. As per my previous updates, investment markets tend to look well in to the future when trying to ascertain whether or not prices are fair, cheap or expensive. This is despite the ongoing issues stated above as investors have identified that equity-based assets do continue to represent value for money. In Australia we are pleased to see a very consistent and sustainable level of dividends and income from most investments and this will continue to be a heavy focus of all portfolios given that we are unsure as to where capital growth will be generated.

You will likely have noted as your adviser, we have continued to place a significant emphasis on exposure to Australian based assets. As we can see by the attached chart (All Ords 2022*) the Australian share market has been very resilient throughout this extremely volatile year, continuing to bounce back each time after a correction. This is even more pronounced when we compare our market at the US share market (attachment DJIA 2022*) which remains the world’s largest listed investment market.

Given the high level of dividends from Australian-based assets and the extra benefit of franking credits, we will continue to hold the majority of client portfolios in Australian shares via direct and wholesale investments for the foreseeable future. It is becoming increasingly difficult to pinpoint individual companies that represent value without taking on very specific risk as to the performance of that company, therefore we feel that engaging with specialist investment managers for the most part will continue to generate the best outcome for your portfolios.

Last but not least, we have attached a recent article from a reputable industry body which demonstrates that engaging with a financial advisor adds significantly to the wealth of clients. It is never too early nor too late to enlist the services of a financial advisor and whilst we a largely at capacity in terms of our clients, we would encourage all connections of our clients to meet with an advisor if they haven’t already done so.

We trust the above and attached are informative. As always, please do not hesitate to contact us should you have any queries or questions.